Our philosophy

Protected positions with Real Estate collaterals

Protected positions with Real Estate collaterals

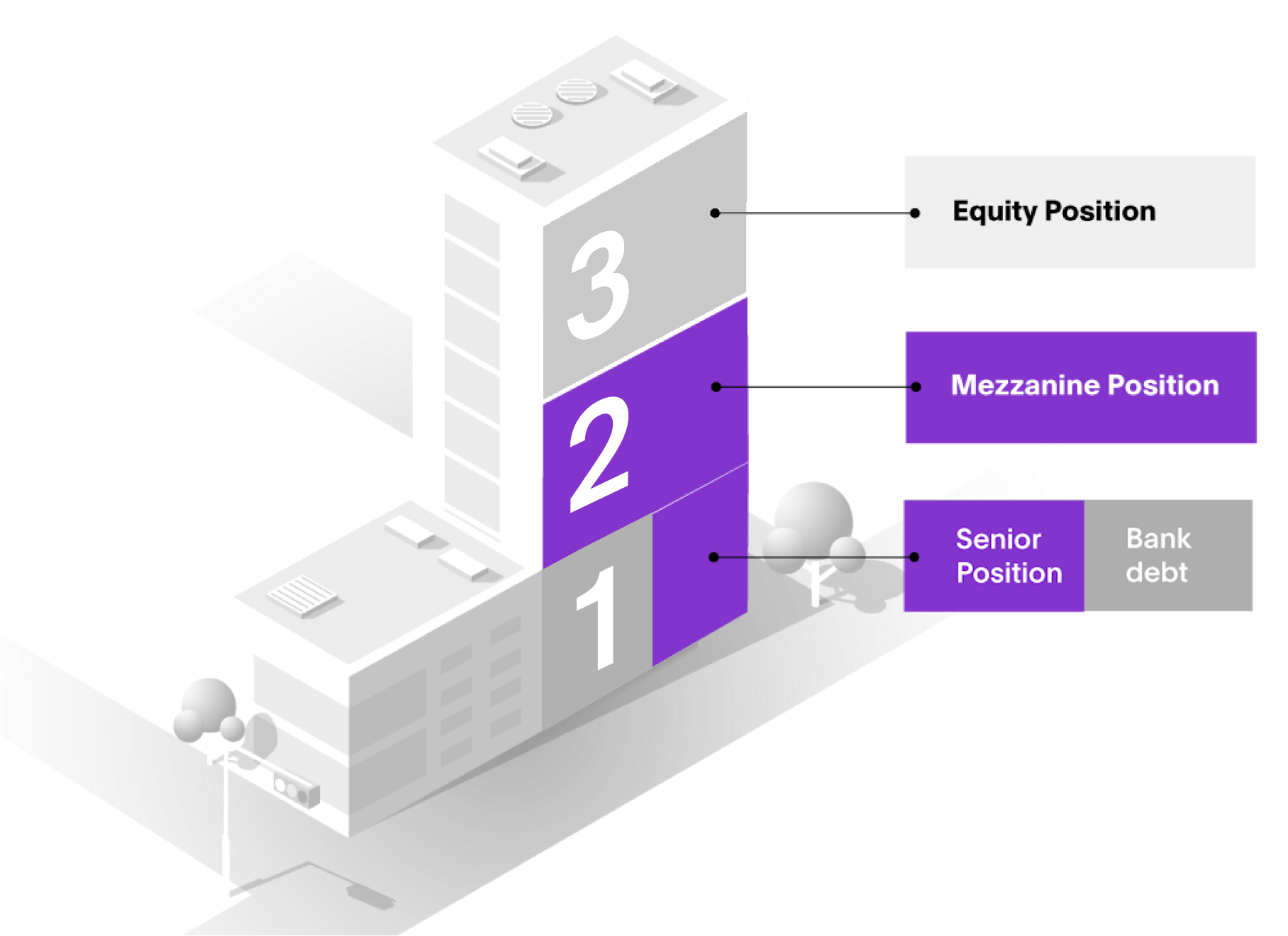

Capital protection

Senior and Mezzanine asset-backed positions

Our investments strategy centers around senior and mezzanine positions with real estate collaterals.

Mezzanine positions fall between sponsor's equity and senior debt in the waterfall of payments, while senior positions take the highest priority of payments, replacing (or complementing) bank financing.

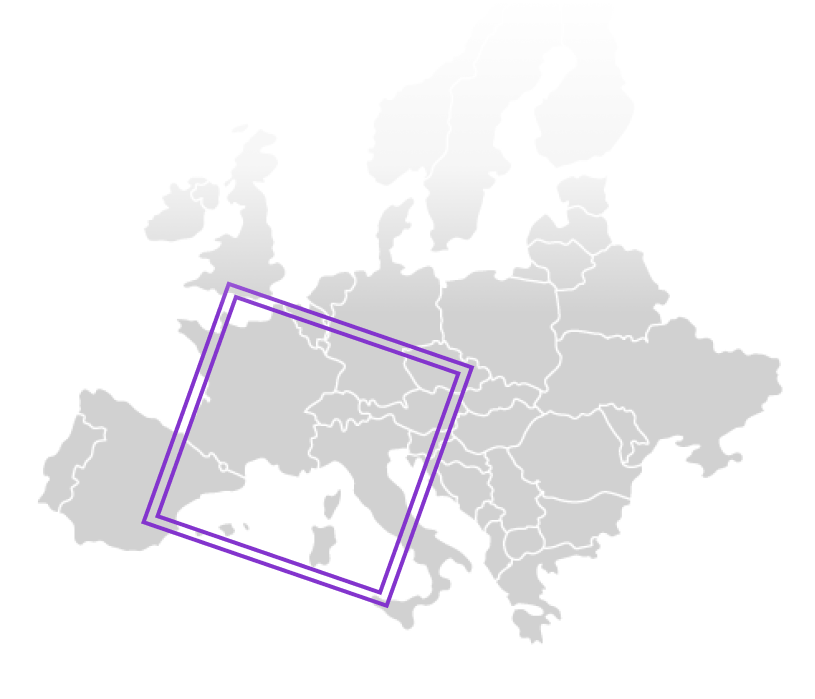

Geographies

Off-market Private Real Estate deals in selected European geographies

Our investment focus lies in Switzerland, Italy, Spain and Portugal, geographies where we have a solid local presence and strong ties with real estate developers, equity investors and institutional asset managers.

Asset classes

Real Estate projects at different stages, across all asset classes

Our pipeline of selected off-market deals includes new constructions, refurbishment projects and income generating properties, with a particular focus on high-end, luxury developments, which can prove resilient in turbulent times.

We consider Real Estate projects at different stages (Core+, Value Add and Opportunistic), across all asset classes, spanning from Residential to Hospitality, also including Logistics, Commercial, Office and Retail.

Hospitality

Commercial

Residential

Opportunistic

Special Situation

Value Add

case study I

Senior loan to finance the development of a luxury hospitality asset in Priorat, Spain

-

Senior loan to finance the development of luxury 5* Hotel in the renowned region of Priorat, one of Spain’s best wine regions.

-

Top-tier Equity Sponsor, world specialist in the development and management of luxury hotels worldwide and particularly in Spain.

-

An institutional collateral package for YELDO investors, including a first-lien mortgage on the asset.

Performance

Our Track Record and Performance

Since 2019, YELDO investments have performed in line with or above targets.

~EUR +1.4Bn

Total transacted value

56

Financed deals

14%

Historical IRR

19

Exited deals